The Clear Advantage: Busting Myths About Down Payment Assistance

By Eboni Killian, Managing Broker

Buying a home is a dream for many, but the down payment can feel like a hurdle. Fortunately, Down Payment Assistance (DPA) programs can help bridge that gap. Let’s clear up some common misconceptions and show you how DPA can put homeownership within reach.

Myth #1: DPA Programs Are Only for First-Time Buyers

While some programs prioritize first-time buyers (those who haven’t owned a home in the past three years), many others are open to everyone. Veterans and buyers in specific areas may find even greater opportunities.

Myth #2: DPA Programs Are Out of Money

Hundreds of millions of dollars in DPA funds exist, thanks to government agencies, non-profits, and even some employers. The availability varies by location, so check with your local or state housing authority for what’s offered in your area.

Myth #3: Qualifying for DPA is Difficult

While requirements vary (income limits, property location, educational courses), starting your research early is key. By being prepared, and working with experienced lenders you can meet deadlines and navigate the process more smoothly.

Myth #4: DPA Makes Getting a Mortgage More Complex

The financing process with DPA is similar to a traditional mortgage. There might be some additional paperwork, but working with experienced lenders can ensure a smooth experience. Some lenders also have funds to layer in their own DPA as well.

Myth #5: DPA Limits You to Low-Cost Homes and Loans

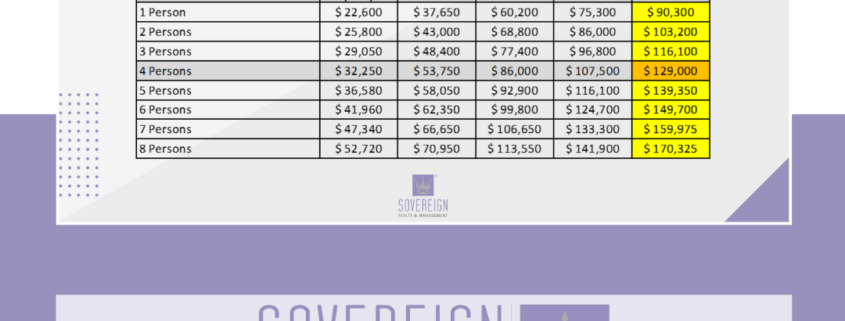

Many DPA programs are compatible with various loan types (FHA, VA, USDA) and can accommodate a wider range of home prices, even in higher-cost markets. DPA programs vary based on your income and where you fall on the Area Median Income chart that is set by HUD annually. There are programs out there that even go up to 120% of AMI. Take a look at the current 2024 AMI guidelines for Metro Atlanta, you’ll be surprised where you may land.

Unlocking the Door to Homeownership

DPA programs can significantly reduce your down payment burden, making homeownership a reality, not depleting your savings, and leaving you funds to furnish your home once you move in. Don’t wait – funding can be limited.

Sovereign Realty & Management Can Help

Our team is here to guide you through the home-buying process, including exploring DPA options. Let’s turn your dream of homeownership into a reality.