“The Best of Times: Let’s Not Spoil It” IREM GA’s 2016 Real Estate Forecast with David Haddow

IREM GA’s Inaugural Luncheon for 2016 was explosive thanks to the presentation by guest speaker David Haddow, President of Haddow & Company a real estate consulting firm founded in 1989 that addresses the needs of developers, investors, lending institutions and other entities in the real estate market. Mr. Haddow starts his whirlwind real estate economic forecast tour with IREM Georgia and is a welcomed fixture to their Luncheon Lecture Series that has enjoyed his presence and expertise for the last sixteen years.

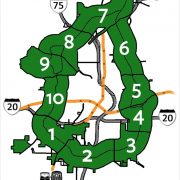

The guests enjoyed a lunch break that involved networking, fine dining, and learning at Atlanta’s prestigious Ansley’s Golf Club. Mr. Haddow greeted the audience with a jovial smile and happily announced that business is indeed good in today’s real estate market. The crowd responded with applause, laughs, and nods affirming his declaration. Mr. Haddow quickly added that when the market is good/ideal, that the real estate community must work hard at sustaining it by being “good stewards”. With that statement, Mr. Haddow addressed the audience with a promising message entitled “The Best of Times: Let’s Not Spoil It” that highlighted the state of Atlanta’s booming 2016 real estate market which included: tremendous employment gains, solid population growth, economic diversification, growth across all real estate sectors, and a comprehensive cheat sheet on how to sustain “the good times” as industry professionals.

Atlanta’s Real Estate Market is experiencing strong employment gains that include an impressive addition of 226,000 jobs added to the market between 2011 and 2014. Atlanta’s job market increased by 3.4% between November 2014 and November 2015 with the addition of 86,500 jobs; this is exciting news for Atlanta’s real estate community because a large number of those new jobs are not just relying on real estate development as the economic driver.

Economic Diversification has helped stimulate the economy by making Atlanta an appealing place for investors, employers, and residents. Atlanta MSA has gained 327,595 new residents in the short span of 2010-2014, a 1.5% increase and there’s been a significant uptick in domestic immigration at 32,294. There is increased diversity in the city’s economic growth from technology, corporate relocations, expansions, filmmaking, healthcare and biotech.

Companies and residents are being drawn from the growth in the tech sector in: payments processing, healthcare, IT, internet security, supply chain management and mobile devices; the major corporate relocations and expansions such as Mercedes Benz, USA, Pulte, and State Farm to name a few; the explosion of the filmmaking industry such as Pinewood Studios, and the strides in healthcare and biotech that can be seen at the new Emory Proton Therapy Center. The presence of these markets lessens the reliance on real estate development as an economic driver for job growth that’s been used in the past. Atlanta has become a hub for corporation relocations and expansions that in turn presents new employment opportunities and new real estate ventures. A diverse economy helps us weather future economic downturns.

Additionally, quite a few of the employment gains are being attributed to the $2 Billion Investments in the new GA Dome, the new Atlanta Braves Stadium, and the construction of in town luxury apartments and condos that are being built to appeal to millennials and empty nesters.

There’s positive rental growth and absorption across all real estate sectors making it a truly exciting time for Atlanta’s real estate community. Presently Atlanta real estate professionals can find the following trends and expectations:

Dr. Debbie Phillips CPM, 2016 President IREM GA and Karen Hatcher, President, Sovereign Realty & Management

The Office Sector is currently booming thanks to the pent-up demand from years of negative absorption. Companies are expanding and investing due to the improved economy. Leases are currently rolling over at elevated rental rates. Office absorption was at 2.6 million square feet in 2015. The good news is that the vacancy and no rental growth that this sector has experienced over the last twenty years are finally over; vacancy rate is currently at 17.5%. There’s been a lack of new office deliveries outside of Atlanta’s Ponce City Market since 2010.

The Industrial Market is experiencing strong absorption with the positive impact of E-Commerce and Filming industries that have made Atlanta home. Atlanta has become home to quite a few distribution centers due to our close proximity to Savannah’s port. There are at least 19 buildings over 500,000 sq. ft. under construction, speculative development is in full swing, and there’s been a significant rise in rent growth.

The Retail Industry is feeling the impact of E-commerce as it’s hard for this sector to compete with its online competitors. High-end grocers are continuing to expand and many of these entities are looking to become anchor stores. Atlanta’s infamous “Murder Kroger” announced its redesign to include retail and office space. This sector is the least poised for development boom but it’s going to be interesting to watch.

The Hotel Industry experienced a 74.1% occupancy rate at full service hotels in 2015. This sector saw a sharp increase in room rates and occupancy since 2011. There is significant development and investment activity in Atlanta’s hospitality market.

The Multi-Family Housing sector experienced the biggest market recovery. The intown apartment market led the market recovery. This sector had high occupancy levels and strong rent growth. However, there is a potential 72% increase in Class A supply (30,412 existing units; 11,068 units under construction in forty communities and another 11,548 apartments proposed) so we must keep an eye on how the additional supply will affect the current positive trends. Despite the new luxury condos that are performing well, the condo/townhome market is relatively dormant.

Single Family Housing is experiencing the early stages of an up cycle with single family home prices returning to 2007 levels in Metro Atlanta except for intown which is significantly higher. There’s still a relatively small supply of homes for sale. In the first half of 2015 single-family purchases was equal to the annual average for the last five years. Slow and steady growth will surely help stabilize this sector.

Mr. Haddow invited the audience to watch the utilization of Fort Gillem that’s going to be transformed into a multipurpose development with Kroger and Fort McPherson as a campus for Tyler Perry’s Studio. The City of Atlanta is poised to sell some major properties including the Civic Center, Underground Atlanta, and Turner Field. The Redevelopment of the GM Doraville Plant and the $250 million in infrastructure bonds to be used should be interesting to watch as well. The Atlanta Beltline expansion is noteworthy for its curb appeal and making Atlanta a real contender in modern urban design. In 2016 we will see cities such as Sandy Springs, Doraville, Dunwoody, and Peachtree Corners become more proactive in real estate. Also, the creation of Ponce City Market is going to be an example of revitalization and utilizing Atlanta’s existing infrastructure to enhance commerce to attract new talent and business.

In addition to talking about the highs, Mr. Haddow instructed the audience to beware of trends that can put an end to “the good times”. To truly be good stewards of our growing real estate market we must be cognizant of the trends that lead to excess. Understand that when there is a disproportionate increase in construction jobs relative to employment that we need to pump our breaks and slow down. Realizing that careless loan underwriting is a recipe for disaster. The economy is cyclical, to have highs you are going to experience lows. When the market transitions from a demand driven market to a capital driven market making money too easy to acquire, it is imperative that we make wise decisions and counsel our clients/colleagues to do the same. Ensuring due diligence is completed is key. Also, watch out for the hyperinflation of land prices and too many developers creating an overbuilt market which will ultimately lead to higher vacancy rates. These are all signs of excess which can lead to a downturn in the market.

Furthermore, as real estate professionals, Mr. Haddow suggested we aid in sustaining “the good times” by continuing to stay abreast of current market conditions, advising our clients to conduct proper due diligence and monitor the key economic measures, employment growth, unemployment rate, per capita income, and leading economic indicators. It is a great time to be in real estate, let’s enjoy and sustain these times!